Financial Literacy for Beginners: Start Young, Build Strong

Financial Literacy for Beginners: Start Young, Build Strong

Financial literacy is now a need rather than an option in a society that is always changing at a quick pace. Given how intertwined the global economy and market are now, this is particularly true. Just think of the potential that a student or anybody else with this basic understanding of money may have! Unfortunately, financial education receives relatively little emphasis in the majority of traditional institutions. Instilling the fundamentals of financial literacy at an early age is not difficult and will help future generations avoid the difficulties that many people face.

Certain effects might be difficult to overcome, and youngsters develop financial habits and attitudes toward personal finance. Students should be taught the importance of budgeting and saving money at that time. It’s important to note how early education may significantly contribute to the development of working people who have sound financial attitudes. Additionally, by teaching these fundamental financial concepts, it helps kids think critically and sensibly about their financial choices rather than just having money to spend.

It is not necessary to have ideas in the back of your head to comprehend the complicated phenomena of finances. No, even straightforward ideas may make a significant impact on a young person’s growing mind. For example, teaching kids how to make a basic budget based on their income and expenses teaches them that need and want may coexist, but that both must be met equally. Savings is also regarded as one of the most important habits that may be formed early on. Students learn about planning and management if they are encouraged to concentrate their efforts on raising money for a field trip or a new gadget.

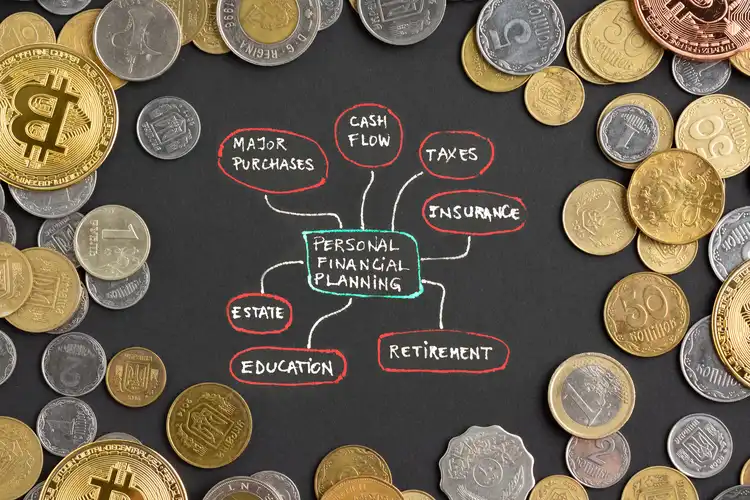

Wise spending is another important idea that teaches kids to distinguish between necessities and luxury. Understanding the behavior of impulsive purchases might teach them useful strategies that could aid in their decision-making. In order to effectively handle future responsibilities, such as using credit cards and understanding interest rates, students must also be conversant with some of the most fundamental ideas of credit and borrowing. As with investing, dissecting it into its most basic elements can help students comprehend how money may grow in size with careful, long-term planning.

Don’t assume that financial literacy of students instruction is dull or overly esoteric. As is well known, practice makes perfect and learning enjoyable. Students decide what needs to be done for a small school project and handle the funds required for it. Games and stories may be used to teach both bad and good financial habits. Parents can further their children’s education by opening a separate bank account for them or assisting them with family budgeting.

Financial literacy has several advantages, and these advantages don’t only stop in infancy. These students become adults who understand how to invest, how to avoid debt, and how to handle any financial crisis. Additionally, they are able to accomplish their goals while contributing to regional economic stabilization. Additionally, financial literacy supports stability and independence, allowing people to thrive in the complicated modern environment.

Early instruction in financial literacy is necessary to ensure that kids understand the fundamentals. These children will be given the means to make positive changes in the world.

Welcome to this vibrant corner of the internet “Dreamy Grace!” I'm Partha, the enthusiastic administrator behind this lifestyle blog. Feel free to explore, engage, and share your thoughts—after all, this blog is as much yours as it is mine. Happy reading!

Welcome to this vibrant corner of the internet “Dreamy Grace!” I'm Partha, the enthusiastic administrator behind this lifestyle blog. Feel free to explore, engage, and share your thoughts—after all, this blog is as much yours as it is mine. Happy reading!

Leave a Comment